U.S. News & World Report just completed their rankings of the best jobs across 17 categories and the oral health category excelled. Below are the highlights:

100 Best Jobs – Dentists were ranked #2. Orthodontists were ranked #4. Oral and Maxillofacial Surgeon were ranked #9.

Best Paying Jobs – Oral and Maxillofacial Surgeons were ranked #3. Orthodontists ranked #5. Prosthodontists #8. Dentists #10.

Best Healthcare Jobs – Dentists were #1. Orthodontists #3.

Consistently across the board, all aspects of the dental and oral health industry scored extremely well.

For more detailed analysis, here is the analysis.

That’s right, this year’s tax legislation has created a quagmire of uncertainty for professional service firms who need extra guidance to identify the loop holes created by last minute legislation. We all know that last minute legislation is like swiss cheese.

That’s right, this year’s tax legislation has created a quagmire of uncertainty for professional service firms who need extra guidance to identify the loop holes created by last minute legislation. We all know that last minute legislation is like swiss cheese. segregation depreciation. Dentists are constantly requesting tax advice from their CPAs as well as their financial advisors. Since they are high-income earners, they want the best people advising them about tax write-offs and how fast they can get them.

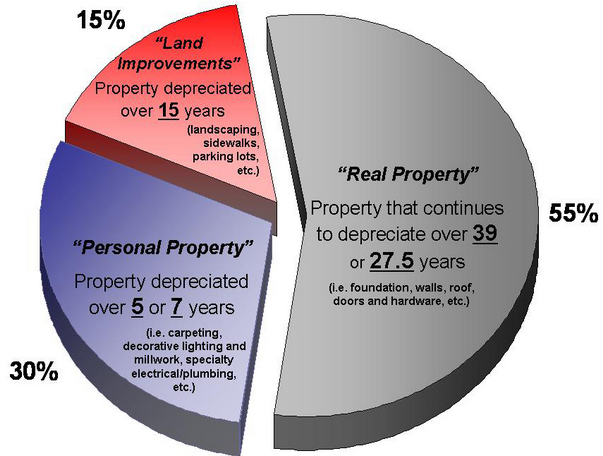

segregation depreciation. Dentists are constantly requesting tax advice from their CPAs as well as their financial advisors. Since they are high-income earners, they want the best people advising them about tax write-offs and how fast they can get them. Many CPA’s do not realize that it is cost effective for a small office building. In years past, cost segregation applied to larger, more expensive commercial buildings (think manufacturing plant, auto dealer, utility, skyscraper office building, mall, etc.). As a result, very few CPA’s recommend cost segregation depreciation and most don’t really understand it very well.

Many CPA’s do not realize that it is cost effective for a small office building. In years past, cost segregation applied to larger, more expensive commercial buildings (think manufacturing plant, auto dealer, utility, skyscraper office building, mall, etc.). As a result, very few CPA’s recommend cost segregation depreciation and most don’t really understand it very well.

questions all the time. Here’s how we typically approach this process and how we monitor performance and production.

questions all the time. Here’s how we typically approach this process and how we monitor performance and production. As part of the dental profit coaching, we like to review key performance indicators (KPIs) of the dental practice to compare and contrast profitability. The SIKKA software makes this process easy for us to evaluate this as well.

As part of the dental profit coaching, we like to review key performance indicators (KPIs) of the dental practice to compare and contrast profitability. The SIKKA software makes this process easy for us to evaluate this as well. on a daily basis. When you consider that the dental practice is a business and the dentist is the highest-paid employee of that business, it’s important that the dentist is producing at a high level.

on a daily basis. When you consider that the dental practice is a business and the dentist is the highest-paid employee of that business, it’s important that the dentist is producing at a high level. Keller also believes having a strategic plan is critical for today’s dental practice. “You have to have a plan in place to monitor this information,” she said. “You need to be asking questions like, ‘Where are we spending our money each month?’ ‘What can we modify or change if necessary?’ ‘What adjustments do we need to make in our spending to keep costs in line or what specific things can we improve upon to increase our production?’”

Keller also believes having a strategic plan is critical for today’s dental practice. “You have to have a plan in place to monitor this information,” she said. “You need to be asking questions like, ‘Where are we spending our money each month?’ ‘What can we modify or change if necessary?’ ‘What adjustments do we need to make in our spending to keep costs in line or what specific things can we improve upon to increase our production?’”