To drill deeper into the dental industry, the Dental Accounting Association members will be travelling to Washington DC for an in-depth series of presentations and round table discussions. The 3rd Annual Dental CPA Summit will commence on May 4, 2018 and precede the AAO Annual.

Our morning speaking will be Susan Gunn. Susan is a nationally recognized speaker and author of 39 books. Her background in criminology in conjunction with expertise on embezzlement within medical practices will be the topic of discussion. Susan’s unique qualifications include being a Certified Fraud Examiner, author of many QuickBooks books, and co-authoring ADA publications on dental financial best practices.

Our morning speaking will be Susan Gunn. Susan is a nationally recognized speaker and author of 39 books. Her background in criminology in conjunction with expertise on embezzlement within medical practices will be the topic of discussion. Susan’s unique qualifications include being a Certified Fraud Examiner, author of many QuickBooks books, and co-authoring ADA publications on dental financial best practices.

Susan has been recognized by Dentistry Today as a Leader in Consulting every year since 2005. The American Dental Association recognized Susan as a Financial Matter Expert in 2015 and she has since been appointed as an ADA Consultant to the Council.

Our afternoon speaker will be Christian Pearson, National Director of Dental Partnerships for Treloar &  Heisel.

Heisel.

Treloar & Heisel is the largest specialty advisor for dental specialists covering disability, professional liability, and wealth management services for over 16,000 dental specialists and has been operating since 1959. Treloar & Heisel works directly nearly every dental specialty association ranging from the American Academy of Pediatric Dentistry to American Association of Oral & Maxillofacial Surgeons and many others.

Dental Accounting Association

The Dental Accounting Association is a network of CPA Firms located in North America working collectively to provide best in class tax coaching, accounting and dental practice coaching to dentists. Our primary focus is on minimizing taxes and closely followed by profit improvement coaching.

And like most dental practices, the Dental Accounting Association members are sole practitioners. And, we are not distracted with investment (retirement savings programs) and dental brokerage services like the larger dental CPA Firms.

Each member of the Dental Accounting Association is still accepting dental clients and offers fixed fee billing, so you don’t have to worry about hourly billing.

While it’s very common for Dental CPA’s to speak at a local dental show on dental practice management, it is an honor to be asked to speak overseas to the second largest dental trade show in the world. In the case of Bassim Michael, owner of

While it’s very common for Dental CPA’s to speak at a local dental show on dental practice management, it is an honor to be asked to speak overseas to the second largest dental trade show in the world. In the case of Bassim Michael, owner of  Bassim has been servicing dentists since 1997 and his CPA Accounting firm provides

Bassim has been servicing dentists since 1997 and his CPA Accounting firm provides  Bassim Michael, CPA, CVA, MS is the founder and president of

Bassim Michael, CPA, CVA, MS is the founder and president of  Bassim is a frequent speaker on topics such as practice management, tax planning and exit planning. He has been quoted in many articles and publications such as the Wall Street Journal, Dow Jones Wire, and many more. He is a founding member of the

Bassim is a frequent speaker on topics such as practice management, tax planning and exit planning. He has been quoted in many articles and publications such as the Wall Street Journal, Dow Jones Wire, and many more. He is a founding member of the

That’s right, this year’s tax legislation has created a quagmire of uncertainty for professional service firms who need extra guidance to identify the loop holes created by last minute legislation. We all know that last minute legislation is like swiss cheese.

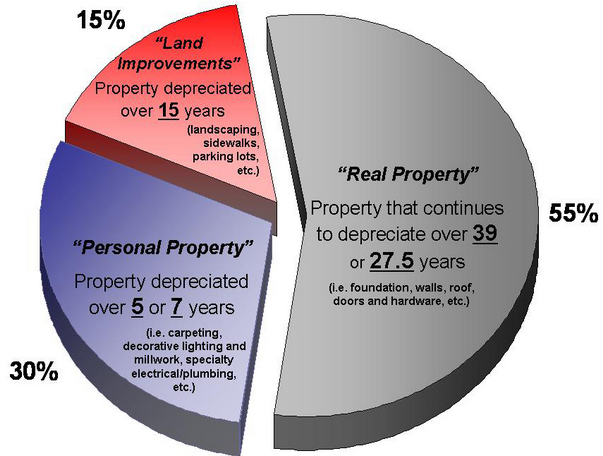

That’s right, this year’s tax legislation has created a quagmire of uncertainty for professional service firms who need extra guidance to identify the loop holes created by last minute legislation. We all know that last minute legislation is like swiss cheese. segregation depreciation. Dentists are constantly requesting tax advice from their CPAs as well as their financial advisors. Since they are high-income earners, they want the best people advising them about tax write-offs and how fast they can get them.

segregation depreciation. Dentists are constantly requesting tax advice from their CPAs as well as their financial advisors. Since they are high-income earners, they want the best people advising them about tax write-offs and how fast they can get them. Many CPA’s do not realize that it is cost effective for a small office building. In years past, cost segregation applied to larger, more expensive commercial buildings (think manufacturing plant, auto dealer, utility, skyscraper office building, mall, etc.). As a result, very few CPA’s recommend cost segregation depreciation and most don’t really understand it very well.

Many CPA’s do not realize that it is cost effective for a small office building. In years past, cost segregation applied to larger, more expensive commercial buildings (think manufacturing plant, auto dealer, utility, skyscraper office building, mall, etc.). As a result, very few CPA’s recommend cost segregation depreciation and most don’t really understand it very well.

questions all the time. Here’s how we typically approach this process and how we monitor performance and production.

questions all the time. Here’s how we typically approach this process and how we monitor performance and production.