While it’s very common for Dental CPA’s to speak at a local dental show on dental practice management, it is an honor to be asked to speak overseas to the second largest dental trade show in the world. In the case of Bassim Michael, owner of Only for Dentists, he will be a speaker at the UAE International Dental Conference on Febuary 6-8, 2018.

While it’s very common for Dental CPA’s to speak at a local dental show on dental practice management, it is an honor to be asked to speak overseas to the second largest dental trade show in the world. In the case of Bassim Michael, owner of Only for Dentists, he will be a speaker at the UAE International Dental Conference on Febuary 6-8, 2018.

The UAE International Dental Conference held in Dubai is the second largest dental event in the world and attracts 48,000 attendees from over 130 countries around the world.

Bassim Michael is a Dental CPA based in California that focuses specifically on dental practices throughout the United States.  Bassim has been servicing dentists since 1997 and his CPA Accounting firm provides tax reduction planning, dental benchmarking and profit improvement coaching.

Bassim has been servicing dentists since 1997 and his CPA Accounting firm provides tax reduction planning, dental benchmarking and profit improvement coaching.

Bassim is also a founding member of the Dental Accounting Association, a leading of Dental CPA’s incorporating technology advances into the profit improvement coaching and dental practice benchmarking.

If you are travelling to Dubai for this show, simply let Bassim know in advance at 877-718-2937.

Bassim Michael, CPA, CVA, MS is the founder and president of

Bassim Michael, CPA, CVA, MS is the founder and president of  Bassim is a frequent speaker on topics such as practice management, tax planning and exit planning. He has been quoted in many articles and publications such as the Wall Street Journal, Dow Jones Wire, and many more. He is a founding member of the

Bassim is a frequent speaker on topics such as practice management, tax planning and exit planning. He has been quoted in many articles and publications such as the Wall Street Journal, Dow Jones Wire, and many more. He is a founding member of the

That’s right, this year’s tax legislation has created a quagmire of uncertainty for professional service firms who need extra guidance to identify the loop holes created by last minute legislation. We all know that last minute legislation is like swiss cheese.

That’s right, this year’s tax legislation has created a quagmire of uncertainty for professional service firms who need extra guidance to identify the loop holes created by last minute legislation. We all know that last minute legislation is like swiss cheese. So what is the amount of A/R that the average dental practice has on its book for more than 90 days? How does the average practice’s A/R compare to its gross production? To find this out, we took data from Sikka Software over the last seven years. The data we are using for this comparison has been collected by

So what is the amount of A/R that the average dental practice has on its book for more than 90 days? How does the average practice’s A/R compare to its gross production? To find this out, we took data from Sikka Software over the last seven years. The data we are using for this comparison has been collected by  Andy Cleveland, dubbed as the

Andy Cleveland, dubbed as the  knowledge of the dental industry to provide tools or guidance on managing Accounts Receivable. For example, Dental Accounting Association members utilize tools like SIKKA and TekCollect to better manage AR and shrink it proactively.

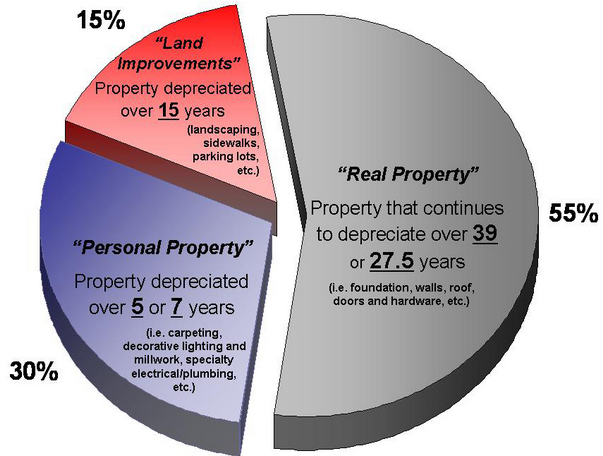

knowledge of the dental industry to provide tools or guidance on managing Accounts Receivable. For example, Dental Accounting Association members utilize tools like SIKKA and TekCollect to better manage AR and shrink it proactively. segregation depreciation. Dentists are constantly requesting tax advice from their CPAs as well as their financial advisors. Since they are high-income earners, they want the best people advising them about tax write-offs and how fast they can get them.

segregation depreciation. Dentists are constantly requesting tax advice from their CPAs as well as their financial advisors. Since they are high-income earners, they want the best people advising them about tax write-offs and how fast they can get them. Many CPA’s do not realize that it is cost effective for a small office building. In years past, cost segregation applied to larger, more expensive commercial buildings (think manufacturing plant, auto dealer, utility, skyscraper office building, mall, etc.). As a result, very few CPA’s recommend cost segregation depreciation and most don’t really understand it very well.

Many CPA’s do not realize that it is cost effective for a small office building. In years past, cost segregation applied to larger, more expensive commercial buildings (think manufacturing plant, auto dealer, utility, skyscraper office building, mall, etc.). As a result, very few CPA’s recommend cost segregation depreciation and most don’t really understand it very well.

questions all the time. Here’s how we typically approach this process and how we monitor performance and production.

questions all the time. Here’s how we typically approach this process and how we monitor performance and production.