If you have kicked around the idea of starting your own dental practice and think you are ready, then this article is for you.

If you have kicked around the idea of starting your own dental practice and think you are ready, then this article is for you.

To avoid many of the pitfalls and risk associated with starting a new business, here are some things that you should be asking yourself and considering.

- Self-Assessment

- Choosing an Entry Strategy

- Develop Business Plan

- Start-Up Costs

- Equipment, Supplies and Inventory

- Staffing

- Dental Practice Marketing and Lead Generation

Self-Assessment

Before you hand in your resignation, here are some questions to ask yourself:

Do I have enough experience to do it myself?

Do I have enough experience to do it myself?- Do I have the drive and motivation to succeed on my own?

- Do I have support from my spouse and family?

- Do I have the capital to get started and operate for at least one year?

- Do I know how to market dental services and generate leads from strangers?

Owning a business can be very rewarding. The process requires planning, hard work, perseverance, and investment. If you can weather the start-up and early development phase, the transition can be wonderful.

Entry Strategy

Most dental practices start using the following entry strategies:

- Buying a practice – This entry approach sounds easier than the other options but has challenges as well. In some markets, the demand for existing practices is red hot and there are not practices to purchase. In other markets, there may not be a practice located exactly where you think a dental practice should be located.

- Starting from scratch – Starting from ground zero allows you to begin without any legacy issues like old pricing, old software, and past-client service issues.

Location for Your Practice

Location for Your Practice

Selecting a location for a new dental practice is beyond important, it’s imperative. That’s why you need to use an expert that specializes within the dental office space industry and can use software tools for location selection. Not a commercial real estate agent that works with all types of businesses from retail to beauty salons, a real estate that is dedicated to dental and medical office space and can negotiate on your behalf without a conflict of interest.

Develop a Business Plan

Like any business initiative, you need to develop a written business plan. A comprehensive business plan should include:

- Goals for your practice

- Target audience that you are serving

- Location is key

- Services that you will offer and which to refer out

- How you will better service your target audience

- Your experience and skills

- Business structure (LLC, S-Corp, C-Corp, etc.)

- Capital requirements and sources

- How to market your new services

- Pricing strategy

- Office, equipment, practice software and staffing requirements

- Projected costs and revenues – start-up, monthly costs, and budgets

Financial Considerations

Before making this leap, it is important to honestly assess if you are prepared to make this transition financially and emotionally. New businesses require sweat equity so this move has to be at the right time in your life. Nearly all practices are cash flow negative during the start-up and development phase so you need to have cash on-hand to cover household expenses and retain insurance coverage.

Dental Practice Marketing and Lead Generation

This is the area that most practitioners need the most assistance because up until this point, they have not been trained on marketing, pricing and practice management. In college and working as an apprentice for another dental practice, the emphasis is on performing the work, not marketing and lead generation.

In today’s world, hanging out your own shingle is not enough to build a business and the number of referrals will be inadequate to achieve your revenue goals.

Start-up Costs

The cost of starting a dental practice depends on your revenue goals, entry strategy, and geographic area. Also, an office in a large city near an office park complex will cost more than an office in a bedroom community that is lightly populated.

There are commercial real estate firms that understand the dental practice needs and costs very well. And it costs you nothing to get their insights and expertise.

There are also dental practice lenders that understand this industry extremely well and can provide additional guidance. Or said another way, you do not want to work with a local retail bank. Your goal will be to secure lending with dental practice lenders who understand the industry backwards and forwards.

One of the key players on your team will need to be a dental practice cpa firm, not a generalist cpa firm. A dental practice CPA will save time and lower your risk on practice acquisition due diligence, business structure, entity selection, and accounting/tax. Typically, they can recommend dental practice real estate firms, law firms, lenders, and other specialists that you will need in your new practice journey. Working with specialists that understand the dental space will lower your risk and save time.

Dental Accounting Association – The Dental Accounting Association is a network of independently owned CPA Firms who have started their own practice at one time. All are single owner firms, not large partnerships. Some started from scratch, some purchased an existing practice, and others have used a combination approach. Regardless, all members of this association can better direct you to specialists who understand the dental industry very well and improve your odds of success. Their goal is to help you over the next 20-30 years, not just get started. If you would like to have a dental practice cpa contact you, click here. The initial discussion is free.

Dental Accounting Association – The Dental Accounting Association is a network of independently owned CPA Firms who have started their own practice at one time. All are single owner firms, not large partnerships. Some started from scratch, some purchased an existing practice, and others have used a combination approach. Regardless, all members of this association can better direct you to specialists who understand the dental industry very well and improve your odds of success. Their goal is to help you over the next 20-30 years, not just get started. If you would like to have a dental practice cpa contact you, click here. The initial discussion is free.

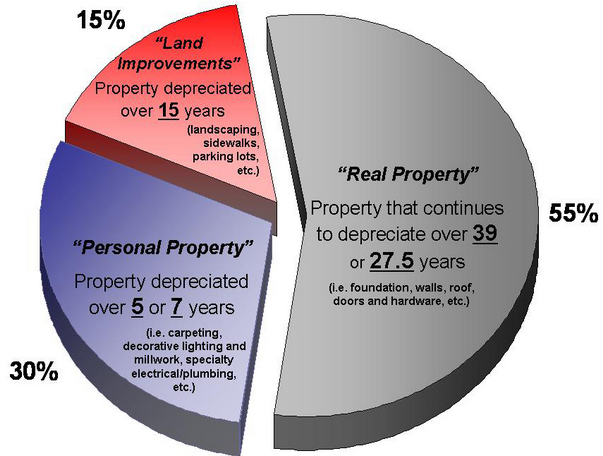

segregation depreciation. Dentists are constantly requesting tax advice from their CPAs as well as their financial advisors. Since they are high-income earners, they want the best people advising them about tax write-offs and how fast they can get them.

segregation depreciation. Dentists are constantly requesting tax advice from their CPAs as well as their financial advisors. Since they are high-income earners, they want the best people advising them about tax write-offs and how fast they can get them. Many CPA’s do not realize that it is cost effective for a small office building. In years past, cost segregation applied to larger, more expensive commercial buildings (think manufacturing plant, auto dealer, utility, skyscraper office building, mall, etc.). As a result, very few CPA’s recommend cost segregation depreciation and most don’t really understand it very well.

Many CPA’s do not realize that it is cost effective for a small office building. In years past, cost segregation applied to larger, more expensive commercial buildings (think manufacturing plant, auto dealer, utility, skyscraper office building, mall, etc.). As a result, very few CPA’s recommend cost segregation depreciation and most don’t really understand it very well.

Eleven Dental CPA’s traveled to San Diego for the American Association of Orthodontists Annual in beautiful San Diego. Considering that the AAO Show was just days after tax season concluded, we accomplished lots of ground on ways to improve our back office systems and enhanced marketing techniques.

Eleven Dental CPA’s traveled to San Diego for the American Association of Orthodontists Annual in beautiful San Diego. Considering that the AAO Show was just days after tax season concluded, we accomplished lots of ground on ways to improve our back office systems and enhanced marketing techniques. Joining the

Joining the  Peter Freuler, owner of Peter Freuler Jr CPA and

Peter Freuler, owner of Peter Freuler Jr CPA and  Bassim Michael, CPA is a frequent presenter on topics such as tax planning, practice management and practice transitions for dentists. Bassim has been quoted by many respected publications including the Wall Street Journal, Dow Jones Wire, Fiscal Times, Dr Bicuspid and may others. Bassim is a member of the American Institute of Certified PublicAccountants, CA Society of CPAs, Fresno Estate Planning Council, Dental Accounting Association, NACVA (National Association of Certified Valuation Analysts), and ACFE (Association of Certified Fraud Examiners). To learn more about Bassim Michael, visit his

Bassim Michael, CPA is a frequent presenter on topics such as tax planning, practice management and practice transitions for dentists. Bassim has been quoted by many respected publications including the Wall Street Journal, Dow Jones Wire, Fiscal Times, Dr Bicuspid and may others. Bassim is a member of the American Institute of Certified PublicAccountants, CA Society of CPAs, Fresno Estate Planning Council, Dental Accounting Association, NACVA (National Association of Certified Valuation Analysts), and ACFE (Association of Certified Fraud Examiners). To learn more about Bassim Michael, visit his  Ali Ormochian, Esq is one of the nation’s leading legal authorities on topics relevant to dentists. Since its creation, the Dental and Medical Counsel PC law firm has been regarded as one of the pre-eminent health care law firms devoted exclusively to health care professionals. His clients seek his advice on dental and medical practice transitions, creation of corporations and partnerships, associate contracts, estate planning, employment law matters, office leasing and state board defense. Additionally, as a respected dental lawyer he is a frequent speaker on topics such as employment law, practice transitions, negotiation strategies, contract and estate pplanning throughout North America. Ali Oromchian has spoken for the American Dental Association, California Dental Association, Hawaii Dental Association, American Association of Orthodontics, California Society of Pediatric Dentistry and countless other state and local dental organizations.

Ali Ormochian, Esq is one of the nation’s leading legal authorities on topics relevant to dentists. Since its creation, the Dental and Medical Counsel PC law firm has been regarded as one of the pre-eminent health care law firms devoted exclusively to health care professionals. His clients seek his advice on dental and medical practice transitions, creation of corporations and partnerships, associate contracts, estate planning, employment law matters, office leasing and state board defense. Additionally, as a respected dental lawyer he is a frequent speaker on topics such as employment law, practice transitions, negotiation strategies, contract and estate pplanning throughout North America. Ali Oromchian has spoken for the American Dental Association, California Dental Association, Hawaii Dental Association, American Association of Orthodontics, California Society of Pediatric Dentistry and countless other state and local dental organizations.