Accounts receivable within every dental practice tells a story. And that story varies within each practice depending upon the approach you take. It tells how big of a bank your dental practice has become, especially when you look at the amount of money that is owed to your practice after more than 90 days.

So what is the amount of A/R that the average dental practice has on its book for more than 90 days? How does the average practice’s A/R compare to its gross production? To find this out, we took data from Sikka Software over the last seven years. The data we are using for this comparison has been collected by Sikka Software from more than 12,500 dental practices from around the United States.

So what is the amount of A/R that the average dental practice has on its book for more than 90 days? How does the average practice’s A/R compare to its gross production? To find this out, we took data from Sikka Software over the last seven years. The data we are using for this comparison has been collected by Sikka Software from more than 12,500 dental practices from around the United States.

Here are the numbers..

Average Dental Practice A/R above 90 days

2011 — $41,111.14

2012 — $48,579.92

2013 — $51,584.39

2014 — $52,571.54

2015 — $49,598.06

2016 — $47,736.21

Average Dental Practice A/R to gross production

2011 – 78.29%

2012 – 85.28%

2012 – 85.28%

2013 – 92.98%

2014 – 98.66%

2015 – 101.27%

2016 – 94.79%

Do you know what your A/R is for more than 90 days? Do you know how it compares to your overall gross production? These are key numbers for any dentist to know. After all, they directly affect the health of your practice.

Andy Cleveland, dubbed as the A/R Ninja, is tonight’s keynote speaker on this exact topic at a dental study club locally and has been nice enough to invite us as well. While Andy’s insights won’t be shared publicly, each Dental Accounting Association will be fully briefed so we can drive down AR.

Andy Cleveland, dubbed as the A/R Ninja, is tonight’s keynote speaker on this exact topic at a dental study club locally and has been nice enough to invite us as well. While Andy’s insights won’t be shared publicly, each Dental Accounting Association will be fully briefed so we can drive down AR.

If you are looking to shrink A/R, there are many tools like SIKKA, TekCollect and the tactics that you deploy within your dental office.

![]()

Selecting a Dental CPA

While working with a local generalist CPA is convenient, a general CPA does not have the time, interest or in-depth  knowledge of the dental industry to provide tools or guidance on managing Accounts Receivable. For example, Dental Accounting Association members utilize tools like SIKKA and TekCollect to better manage AR and shrink it proactively.

knowledge of the dental industry to provide tools or guidance on managing Accounts Receivable. For example, Dental Accounting Association members utilize tools like SIKKA and TekCollect to better manage AR and shrink it proactively.

If you are searching for a higher level of expertise, visit the Dental Accounting Association website to locate a Dental CPA nearby or contact us and we’ll make an introduction for you.

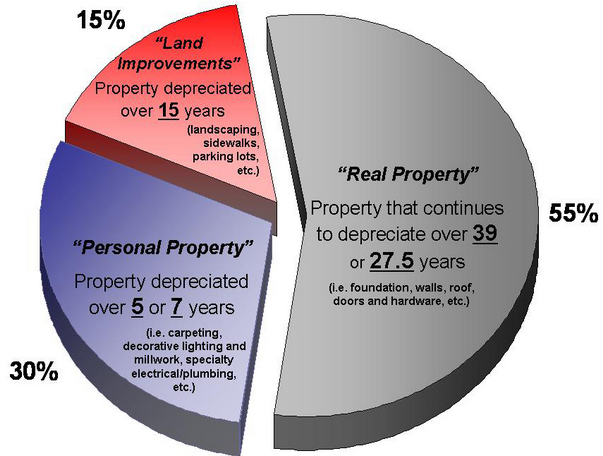

segregation depreciation. Dentists are constantly requesting tax advice from their CPAs as well as their financial advisors. Since they are high-income earners, they want the best people advising them about tax write-offs and how fast they can get them.

segregation depreciation. Dentists are constantly requesting tax advice from their CPAs as well as their financial advisors. Since they are high-income earners, they want the best people advising them about tax write-offs and how fast they can get them. Many CPA’s do not realize that it is cost effective for a small office building. In years past, cost segregation applied to larger, more expensive commercial buildings (think manufacturing plant, auto dealer, utility, skyscraper office building, mall, etc.). As a result, very few CPA’s recommend cost segregation depreciation and most don’t really understand it very well.

Many CPA’s do not realize that it is cost effective for a small office building. In years past, cost segregation applied to larger, more expensive commercial buildings (think manufacturing plant, auto dealer, utility, skyscraper office building, mall, etc.). As a result, very few CPA’s recommend cost segregation depreciation and most don’t really understand it very well.

questions all the time. Here’s how we typically approach this process and how we monitor performance and production.

questions all the time. Here’s how we typically approach this process and how we monitor performance and production. Maybe you’re looking at this area of your practice and wondering how you can boost your numbers? Some of it may involve the extraction of teeth for implant placement. Some of it may involve oral cancer screenings. Boosting this area of your practice could mean it’s time to look at your treatment mix and see what you’ve added in recent years.

Maybe you’re looking at this area of your practice and wondering how you can boost your numbers? Some of it may involve the extraction of teeth for implant placement. Some of it may involve oral cancer screenings. Boosting this area of your practice could mean it’s time to look at your treatment mix and see what you’ve added in recent years. on a daily basis. When you consider that the dental practice is a business and the dentist is the highest-paid employee of that business, it’s important that the dentist is producing at a high level.

on a daily basis. When you consider that the dental practice is a business and the dentist is the highest-paid employee of that business, it’s important that the dentist is producing at a high level. Keller also believes having a strategic plan is critical for today’s dental practice. “You have to have a plan in place to monitor this information,” she said. “You need to be asking questions like, ‘Where are we spending our money each month?’ ‘What can we modify or change if necessary?’ ‘What adjustments do we need to make in our spending to keep costs in line or what specific things can we improve upon to increase our production?’”

Keller also believes having a strategic plan is critical for today’s dental practice. “You have to have a plan in place to monitor this information,” she said. “You need to be asking questions like, ‘Where are we spending our money each month?’ ‘What can we modify or change if necessary?’ ‘What adjustments do we need to make in our spending to keep costs in line or what specific things can we improve upon to increase our production?’”